Chartered Institute of Management Accountants

CIMA (Chartered institute of Management Accountants) established in the year 1919, is a globally recognized qualification for careers in Business & Finance. CIMA is the world’s largest professional body of Management Accountants with more than 250,000 members working in around 180 countries. CIMA qualified professionals work in the field of Corporate Finance, Financial Reporting, Financial Analysis, Business Analysis, Project Finance, Treasury Management, Risk Management etc.

In collaboration with the CPA (USA) institute, CIMA members receive an additional designation- CGMA. CIMA has more than 4500 training and recruitment partners across the globe.

Management accountants analyze information to advise strategy and drive sustainable business success. Anyone can study the CIMA qualification, whether they’re new to finance and business or an experienced professional.

Why CIMA?

CGMA

Since the tie up of CIMA & CPA which together give the CGMA Designation, you are sure to catch the eye of the recruiter

Networking

More than 4500 companies are the partner of CIMA around the world and 250000 members in around 180 countries, you get the advantage of exploring job opportunities or business opportunities.

Flexibility

CIMA has the flexibility for the students to study at their own pace and manage their work and study for optimum learning

Cost Effective

Registration, training and examination fee together can cost between Rs. 9 to 11 Lakhs depending upon your prior qualification.

Preferential Immigration Status

Due to the collaboration of CIMA with professional bodies CPA Australia, CIMA members get preferential immigration status abroad.

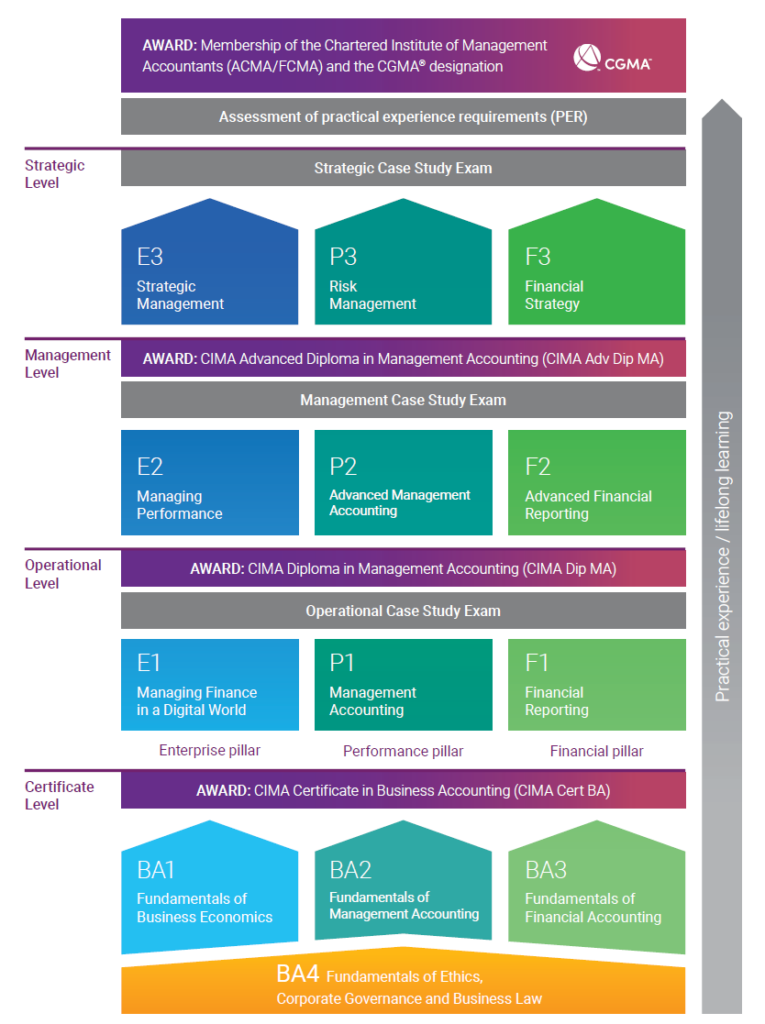

CIMA Course Structure

Inquire now!

Why Achievers for CIMA?

World class

lecture panel

Option of attending

physical / online

Study while you

are at home

Unbelievable

pass rates

Comprehensive

study materials

Access to

recorded lectures

One to one

student support

Library

access

Flexible

payment methods

In-house computer

based exam center

Achievers at a Glance

Timetables

Call us now

FAQs

The minimum entry qualification to start CIMA is if you are after G.C.E O/Ls or G.C.E A/Ls, then you can start from stage 1. Your age should be more than 16 years to study CIMA. If you have already completed another qualification, then you are eligible to get exemptions.

There are five categories of fees that a student has to pay while pursuing the course.

Course fees: Students will have to pay the course fees to get the tutoring, learning materials and the support from Achievers

Registration fees: New students pay a one-time registration fee, which includes their first year’s subscription fee. Note: The CIMA subscription year runs from 1st January until 31st December.

Subscription fees: To study CIMA, you need to pay an annual subscription which is due on 1 January each year.

Exam Fees: The student has to pay exam fees for every examination.

Exemption fees: If a candidate is entitled to any exemptions he/she needs to pay exemption fee per paper being exempted. It is usually equivalent to the exam fees of the corresponding paper

Objective type Questions:

The Objective Test Questions (OTQs) are used to assess all the certificate level and professional level subjects. You can take the assessment at any time of the year whenever you feel ready. OTQ have different types of question such as Drag & Drop, Hotspot, Short answer (normal calculation), Drop down, Matching, Ranking, Sentence completion.

Case Study Exam

You need to clear all three objective tests (or receive exemptions for them) from a single level before you can take a case study exam. In the case study exam, you have to apply your knowledge and learning across the three pillars at each level.

The case study exam is set to make the students understand a real business environment. The case relates to a fictionalized organization, however, it is based on real business or industry. Passing the case study exam will showcase your ability to apply the technical, business, people and leadership skills from the three subjects at a particular level in a business context. CIMA assesses various skills in the case study exams which includes research and analysis as well as skills to present and communicate information.

Most accounting qualifications such as CA, CMA prepare candidates for private practice, financial reporting, audit and tax issues. In contrast, CIMA prepares you for a career in business. CIMA prepares you to work across an organisation, not just within finance. In addition to strong accounting fundamentals, CIMA teaches strategic business and management skills. CA takes more than 4 years to complete the qualification and the passing rate is about 5% per level whereas CIMA takes approximately 2-3 years to complete and the passing rate is about 50% to 60%. CA is recognised in Sri Lanka whereas CIMA is recognised in around 180 countries. Moreover, many companies across the world are managed by CIMA members. This is the reason why many companies are looking for CIMA members in Sri Lanka as well.

CIMA focuses on Business which includes Management, Costing & Financial Accounting whereas the focus of ACCA is more on auditing and accounting work. CIMA and ACCA members are present across the globe.

If you have completed all 3 stages of AAT Sri Lanka then you can get the exemptions for the stage 1 of CIMA & Financial Reporting (F1) subject from stage 2 of CIMA (5 subjects exempted) and the exemptions fee is waived off as well. If you have partially completed AAT (completed only stage 1 or 2) then you will not be eligible for any exemption in CIMA